The Insurance Industry In Wartime

Think they just sat around and wrote policies?

Like using the button below; only I can see who you are.

Insurance is based on risk.

The Code of Hammurabi mentions insurance, suggesting ways for merchants to limit the risk of ships and cargoes on treacherous routes, or to buy what amounted to early bonds to cover potential losses. Achaemenian monarchs insured their people, notably free servants. Givers also insured their significant gifts to kings and queens during transit. Members of benevolent societies from ancient Egypt on paid into their society funds that would share out funds when a member became ill or passed away. Sounds obvious, but early insurance was based on mutual benevolence, on the goodwill of the insurer. The first insurance policy not tied to a benevolent society, loan, or contract was issued in Genoa in 1347. This was the first time anything was insured without either a prior relationship or a financial commitment other than that in the policy. It was all pretty simple when only humans were involved. Then business got into it.

The Great Fire of London begat modern (business-based) insurance.

In 1666, after fire destroyed over 30,000 homes, Nicholas Barbon started a building insurance business in the City of London—the financial district. He later introduced the first modern fire insurance company. Just before that, in 1662, John Graunt, a London draper, showed that there were predictable patterns of longevity for groups of people. This study became the basis of a life table. Combining an ability to predict life expectancy with the miracles of compound interest and annuity, it was possible to create an insurance scheme to provide life insurance or pensions for a group of people. This is how finance and insurance became joined.

This is also how insurance started to think in terms of group risk.

The word underwriter derives from risk takers writing their names under the total amount of risk/investment that he would accept at a specified premium. This practice started at Lloyds of London’s insurance market in 1769. At that time, insurance policies/contracts of this nature were covered by pools of investors, usually for a cargo or a shipping route. As time passed and the insured did not cash the policies in, the premiums were still collected, insurance companies could afford to take/make other risks/investments, such as buildings or accidents. Accident insurance began in the late 19th Century, with coverage benefits very similar to modern disability coverage.

As insurance companies grew, so did cities and towns.

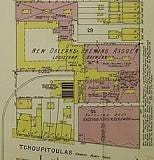

Fire/property insurance began after the Great Fire of London in 1666 and spread to every industrial region in the world by the end of the 19th Century. As it became more popular, insurance companies adapted actuarial, statistical methods to structures. As the buildings grew, so did the need for fire protection, professional firefighters, and fire equipment designed to fight fires in particular kinds of structures. Insurance companies started their zoning practices, based on things like Sanborn Maps, first drawn in 1867.

Sanborn and his competitors analyzed cities and towns, grading them on how flammable they were based on what they were made of, what fire protection measures were in place, what was in the structures, and how they might propagate a fire. This was important when writing insurance for adjacent buildings. At the same time, insurance companies also started looking at building materials such as the new asphalt roofs starting in 1903, in Grand Rapids, Michigan. They were also interested in the risks posed by electrical distribution, and by introducing gas into homes for lighting, cooking and heating. Since about half the structures in most cities worldwide were insured by 1900, the insurance industry was interested in nearly everything that went into building construction and protection everywhere.

The insurance industry as we know it today was still fairly new in the 1940s.

In 1894, the Underwriter’s Laboratories were founded in Northbrook, Illinois by William Merrill, who had been an electrical inspector for the 1893 Columbian Expostion in Chicago. Merrill conducted experiments on materials and structures used in the Columbian Expo, using his own resources, and founded UL to provide better testing facilities for insurance companies and manufacturers. It wasn’t long before insurance companies brought materials and issues to UL. In 1896, the National Fire Protection Association (NFPA) was founded in Quincy, Massachussets to standardize automatic sprinkler system plumbing. The first NFPA standard became scores, and as word spread, more companies and municipalities needed more standards. When WWII began, both UL and the NFPA knew a great deal about fire.

They knew how to start fires, and how to stop them everywhere in the world.

Because the United States had pioneered materials testing and inspection specifically for fire, they were in a unique position in terms of technical intelligence. In April 1943, NFPA engineers, who had been working with the RAF for two years, began working with the USAAF on incendiary warfare. They and UL built and burned full-scale models of structures that existed in Europe and Asia. They simulated fire protection systems and techniques they had specified and constructed everywhere, and showed how to defeat them. Insurance companies provided compiled data on delivered equipment, on fire mains, on installed equipment, and on past performance of firefighters in every major Axis city. The insurers knew all this, regardless of where it was, because they insured not just businesses and buildings, but embassies and consulates. They knew the hearts of Tokyo, Rome and Berlin, of Paris and Warsaw and Rotterdam and Oslo better than their fire departments did. And of all those cities, they knew Tokyo was more kindling than building.

The Fire Blitz: Burning Down Japan

The insurance industry had a vital role in advising the military how vulnerable Japan was to incendiary bombing.

The Fire Blitz is about taking advantage of that vulnerability, and how it helped to bring Japan not to its knees, but to its very ankles. It will be available on 9 March; preorder now from your favorite bookseller or get your order in with me today.

Coming Up…

The Fire Blitz: Burning Down Japan

Armored Cruisers: The Flame

And Finally…

On 2 March:

1793: Sam Houston is born in Rockbridge County, Virginia. Houston has the unique distinction of being a governor of two states (Tennessee and Texas) and twice the president of an independent country (the Texas Republic), and the Commander-in-Chief of a foreign army (Texas). He spoke Cherokee and was fiercely against Texas secession. Also on this day in 1836, Texas declared its independence from Mexico, and on this day in 1861, the Confederacy admitted Texas.

1943: The battle of the Bismarck Sea begins between the Papua Peninsula of New Guinea and New Britain. One of the many forgotten battles of the Pacific War, the Bismarck Sea fight was one of the most one-sided actions in any conflict. In three days of air attacks by USAAF and RAAF land-based aircraft, Japan lost eight troop transports and four destroyers, and over 6,000 men compared to six Allied aircraft lost, and less than fifty men.

And today is NATIONAL READ ACROSS AMERICA DAY (DR. SEUSS DAY), in commemoration of the birth of Theodore Geisel in 1904. So, how do you like green eggs and ham?